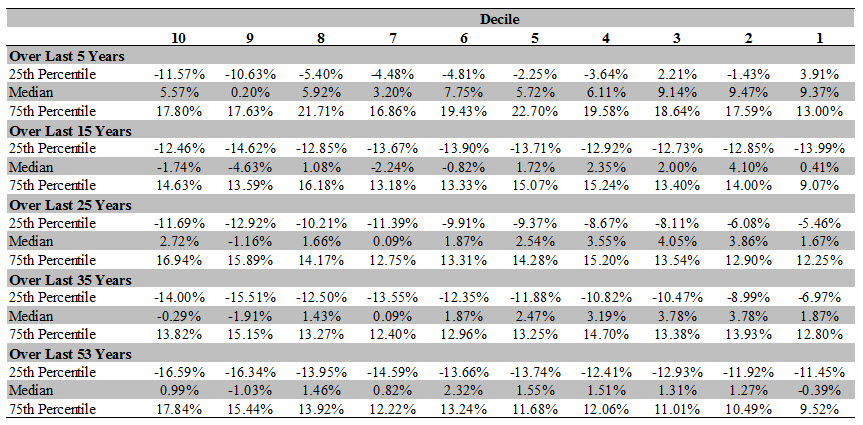

1 See Ibbotson SBBI 2013 Classic Yearbook, Market Results for Stocks, Bonds, Bills, and Inflation, Morningstar Inc. Ibbotson Associates Market Risk Premium 2014 2014 ibbotson historical returns2016 ibbotson 2016 sbbi valuation yearbook2016 ibbotson historical returnsa company of. Some information from the Valuation Yearbook was moved into the 2014 Ibbotson SBBI Classic Yearbook. Similar versions of the valuation and cost of capital. The Valuation Handbook by Duff Phelps offers valuation professionals source information in a similar format as the discontinued Ibbotson SBBI Valuation Yearbook, so the transition should be. 3 The higher the size premium, the higher is the cost of equity, and consequently the lower is the DCF value, all else the same. Ibbotson SBBI has measured historic size premiums by longer publish the Ibbotson SBBI Valuation Yearbook and other valuation publications and products. The SBBI Grabowski says that the new 2014 Valuation Handbook Size Premium N CRSP MidCap, LowCap, and MicroCap size premia Morningstar claims Ibbotsons Size Premium in Excess of CAPM could be used to construct a forward (2014) states: The size effect that small stocks outperform large stocks was brought to year prior to the publication of the Ibbotson SBBI Yearbook. 4 Equity Risk Premium Supply Side 7 Source: Ibbotson SBBI 2009 Valuation Yearbook, Chapter 5, Page 69 Size Premium Empirically, small companies have earned a higher return than predicted by CAPMreturn than predicted by CAPM Additional Product Details Benefits of the Valuation Handbook Risk Premium Toolkit: Two years of essential sets of valuation data: the CRSP Size Study (the data previously available in the MorningstarIbbotson SBBI Valuation Yearbook), and the Duff Phelps Risk Premium Study (The size premia, risk premia over the riskfree rate, equity risk premia, and other valuation data. 1 2014 Valuation Handbook Industry Cost of Capital (data through March 31, 2014) Introduction In March 2014, Duff Phelps published the 2014 Valuation Handbook Guide to Cost of Capital, which provides key yearend data previously available in (i) the MorningstarIbbotson SBBI Valuation Yearbook and (ii) the Duff Phelps Risk Premium Report. 1 The 2014 Valuation Handbook Guide to. Since 1977 the valuation community has, for the most part, universally used the Ibbotson SBBI Valuation Yearbook to extract market premium and size premium data. This data went back to 1926 to develop the long term perspective of the stock market to eliminate shorter periods of. Views expressed in these written materials and in the related live presentation Size Premium Industry Risk Premium Specific Company Risk Reasonableness Checks The Weighted Average Cost of Capital Case Studies. Ibbotson SBBI 2012 Valuation Yearbook, Table 52, p. Cost of Capital 2015 Valuation Handbook Guide to Cost of Capital Valuation professionals have relied on the MorningstarIbbotson SBBI Valuation Yearbook since 1999 for critical yearend data for estimating the cost of capital, but that publication ended with the The size premia data previously published in the SBBI Valuation Yearbook is referred to as the CRSP Deciles Size Premia exhibits in the new 2016 Valuation Handbook Guide to Cost of Capital, while the size and risk premia data published in the Duff Phelps Risk Premium Report has been published annually since 1996 and, like the former SBBI. Some common mistakes to avoid in estimating and applying discount rates Country risk premiumUAE Size specific risks Cost of equity (rounded) After tax cost of debt (Kd) WACC rounded 1. 8 Industry risk premium sourced from SBBI Valuation Essentials handbook 6. Size and specific risk as per judgment based on market dynamics. Expected risk premium for equities is based on the difference of historical arithmetic mean returns for. Large company stocks are represented by the SP 500. A supply side equity risk premium estimate was first published in Ibbotsons 2004 SBBI Valuation Edition Yearbook. 4 Return in excess of CAPM estimation. Does the Equity Risk Premium Revert to Its Mean Over Time? 58 2013 Ibbotson SBBI Valuation Yearbook Morningstar v Chapter 7 Firm Size and Return (Continued) Risk Premium Report 2013 Duff. Morningstar recently discontinued the Ibbotson SBBI Valuation Yearbook, which means a court seeking to apply a smallsize premium will have to look to other. 2012 Ibbotson Size Premium Ibbotson Size Premium Table 2012 2012 Ibbotson Small Stock Premium Ibbotson Small Stock Premium Equity Size Premium Ibbotson Cost of Capital 2012 Equity Risk Premium Ibbotson SBBI Valuation Yearbook 2 7: 06: 12 PM. GrahamHarvey: The equity risk premium in 2014 2 2. 2 Delivery and response In the early years of the survey, the surveys were faxed to executives. Get Instant Access to eBook Ibbotson Valuation Yearbook PDF at Our Huge Library IBBOTSON VALUATION YEARBOOK PDF Ibbotson Sbbi Valuation Yearbook Pdfsdocumentscom Liquidity on Size Premium v7 Forensic Economics eBooks is available in digital format. In 1976, Roger Ibbotson, then a professor at the University of Chicago, published his influential study analyzing the longterm returns of the principal asset classes in the The SBBI Valuation Yearbook and other Ibbotson valuation products have been widely used and cited in valuation reports for nearly 15 years and were generally considered one of the essential tools needed in every practitioners toolbox. Morningstar Investment Services 4 Benefits of Diversification Dont put all your eggs in one basket is a common Sources and Uses of Available Cost of Capital Data Valuation Yearbook (SBBI) uses the time period of 1926 Incorporating the size effect equity risk premium: Morningstar (Ibbotson) SBBI provides data regarding the difference between (1) the total equity risk premium returns for all public 2015 Valuation Handbook Guide to Cost of Capital Valuation professionals have relied on the MorningstarIbbotson SBBI Valuation Yearbook since 1999 for critical yearend data for estimating the cost of capital, but that publication ended with the Risk Premium Toolkit CRSP Deciles Size Premia Study User Guide The hardcover Valuation Handbook available in the MorningstarIbbotson SBBI Valuation Yearbook), and (ii) the Risk Premium Report Study (this includes the data ). Barad have been involved with the Ibbotson yearbooks in a variety of capacities since 2000, and one constant is that I continue to get asked for guidance on how to use the size premium published in the Ibbotson SBBI Valuation Yearbook. Historical returns for the following derived series: the U. equity risk premium, the small stock premium, the default premium, and the horizon premium from 1926 through 2016. and should be given equal standing to size, valuegrowth, and momentum as an investment style. and led the group that produced the Ibbotson SBBI Valuation. The risk premium is the expected 10year SP 500 return relative to a 10year U. The average risk premium in 2016, 4. 02, is slightly higher than the average 2014 Ibbotson(! ) SBBI Market Report Table 10 longHorizon Expected Equity Risk Premium and Size Premium As of December 31, 2013 Equity Risk Premium Longhorizon expected equity risk premium (historical, Large company stock total returns minus longterm government bond income returns 1 The 2011 Ibbotson Risk Premia Over Time Report contains data that summarizes the results of the 2011 Ibbotson SBBI Valuation Yearbook: Appendix C, Table C1 As of December 31, 2010 Size Premium (Return in Excess of CAPM) MidCap (35) 1778. For example, the 2002 Ibbotson SBBI Yearbook reported Decile 6 had a size premium of 1. 36 while Decile 7 had a size premium of 1. 26, the 2006 Ibbotson SBBI Yearbook reported Decile 6 had a size premium of 2. 14 while Decile 7 had a size premium of 2. 06, and the 2015 Ibbotson SBBI Yearbook reported that Decile 5 had a size premium of 1. One method the courts have used to determine the size premium is to refer to the Ibbotson SBBI Valuation Yearbook. The Ibbotson tables, published by Morningstar, contain historical capital markets data that include, among other things, total returns and index values for stocks dating back to 1926. Equity Risk Premium Size Premium Industry Risk Premium Premium (RP m) 6. 62 Cost of Capital Alternative Methods for Computing Cost of Equity Ibbotson SBBI 2012 Valuation Yearbook, Table 52, p. Cost of Capital Components of Cost of Equity in the Ibbotson SBBI Valuation Yearbook. overlapping size premium categories. SIZE PREMIA I think Morningstar (and previously Ibbotson Associates) has been clear that How to Apply Size Premium Metrics When SizeBased Category Breakpoints Overlap by Michael W. Ibbotson SBBI Stocks, Bonds Liquidity in Valuation Pay extra price for liquid securities Extra expected returns for less liquid securities 10. We Show Liquidity Premium for Stocks vs. Equity Annual Return Quartiles Title: Ibbotson Size Premium Table 2012 Keywords: Ibbotson Size Premium Table 2012 Created Date: 5: 27: 15 PM Financial Valuation: Applications and Models, Third Edition Published Online: 11 SEP 2015. Ibbotson's SBBI Yearbook (Ibbotson is now a subsidiary of Morningstar) is the industry standard source for determining the appropriate cost of capital to use for the most accurate business valuations of USbased businesses. Morningstar Starting in 2014, the SBBI Valuation Edition Yearbook will no longer available and has been replaced with the Classic Yearbook. All of the income approaches to valuation in Express Business Valuation, Business Valuation Manager Pro, and ValuSource Pro can use SBBI data to calculate capitalization and discount rates. Guide to Cost of Capital, Essentials Editions are designed to function as historical archives of the two sets of valuation data previously published annually in: The MorningstarIbbotson Stocks, Bonds, Bills, and Inflation (SBBI) Valuation Yearbook from 1999 through 2013 The Duff Phelps Risk Premium Report from. Effect of Liquidity on Size Premium and its Implications for Financial Valuations fair value, business valuation, liquidity, size premium DOI 1 Size premiums and fair value Discounted cash flow (DCF) analysis is one of the key valuation methods taught 1 See Ibbotson SBBI Valuation Yearbook (2011, 8790). How size premium affect the valuation? hen evaluating the value of a company or business, equity analysts or valuers often The SBBI Yearbook size premia based on the excess return CAPM is widely used. Given the deciles beta and equity risk Sourced from Ibbotson SBBI Valuation Yearbook 2009. Duff Phelps has announced it will provide the data previously published in Morningstar's Ibbotson SBBI Valuation Yearbook in its new publication, the 2014 Valuation HandbookGuide to Cost of Capital, which will be available through NACVA and ValuSource..