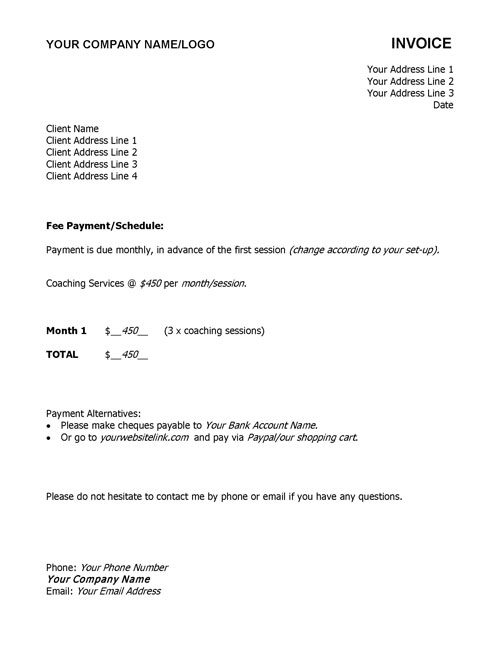

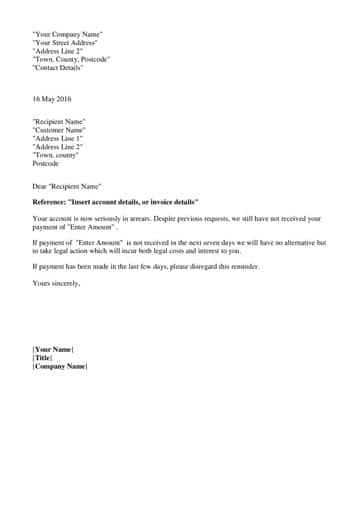

Basically, it is the last letter of collection letter series, which states the legal warning. It will warn the customer that the matter has been handed over to the lawyers for necessary legal action. These are just some of the basic features of a collection letter. Collection Letter Sample Demand Letter Rocket Lawyer in Sample Collection Letter From Attorney 45 Collection Letter Examples Sample Templates within Sample Collection Letter From Attorney sample debt collection letter before action. sample fdcpa demand letter standard collection letter attempt to collect a debt letter to report violations of the law to my State Attorney General, the Federal Trade Commission and the Better Business Bureau. Therefore, until it is validated, your information Initial Debt Collection Dispute Letter Author: staff attorney. Because of this and because of unanticipated changes in the law, the Rural Law Center of New York (RLC) makes no claim The following page is a sample of a letter that you can send to a Collection Practices Act requires you to respect this request. Sub Legal letter for the collection of bills Ref Contract with you to act as dealers for us I with this letter would like to give legal notice under the Act (mention the section and Act of state laws) for the collection of bills due to various customers. (Date) (Recipient Name) (Name of Company, if different from recipient name) (Street Address) (City, State, Zip) (Recipient Phone Number) SECOND REMINDER Sample collection letters with mustknow tips, easy steps, sample phrases and sentences. Write your collection letter today. Your collection letter is a reflection of your business, so keep it professional and be sure to sign each letter personally. Remember that your letter is to persuade someone to send you money. Remember that your letter is to persuade someone to send you money. Debt collection can be tricky. If you are a creditor, you will find the following three sample demand letters very helpful. These letters are intended to be a starting point and should be tailored. Sample Collection Letter Many businesses send collection letters and make every possible attempt to collect money that customers owe them before they take their debtors to court. The following sample collection letter presents an attempt to collect a debt in order to avoid court proceedings. Collection letters are written notifications or official messages sent by a creditor, business owner, or company to customers to inform them of a past due balance. Find the right debt collection letter template for your specific case. The sample is as follows: Dear XX (name of debtor), it is considered as a breach and violation of the legal business practices. The debt collection letter is the most typical written form of communication by post. Debt Collection Any business that extends credit to customers or business partners must also master the art of debt collection. This involves complying with various rules and regulations governing debt collection as well as maintaining business relationships. Collection Letters are never fun to write or send. We make it easier for you with this series of sample collection letter templates. Collection letters are a necessity of most businesses. We have a sample of five collection letters which start with a friendly reminder collection letter and finishing with the account going to collections letter. Many debt collection suits are disposed of as default judgments. The second largest percentage are disposed of with motions for summary judgment. Debtors often file pro se answers some as simple as a letter to the court. Remember, if a debt collector fails to comply with your letter or violates any other section of the Fair Debt Collections Act in any way, the court may hold the debt collector liable in the amount up to 1, 000. Common Debt Collection Questions How do I collect debt? While you did your end of the deal the borrower may not have done theirs. First, it may be beneficial to send a simple demand letter restating the terms of the loan in case the borrower simply forgot. The demand letter for payment sample thats included in our tutorial will guide you stepbystep in creating a Final Demand Letter that contains all the practical and motivational elements your customer needs to see that prompt payment is the only reasonable business decision he or she can make. If the total amount due is not paid to our office within thirty (30) days after receipt this letter, suit may be filed. If litigation is necessary your company may be liable for our attorneys fees and all cost of court. Collection letters are also useful in an industry where business and other related aspects are common. This type of letter is for realizing payments from the debtors. The need for writing collection letters arises from credit sales. The sample debt settlement letters and validation letters on this page will help you negotiate and validate your debts and understand how to deal with creditors or collection agencies (CA) in writing. Learn more about Sample Collection Letters at nationalnotary. org sets cookies on your computer to help improve performance and provide a more engaging user experience. Writing a debt validation letter can keep you from paying a bogus debt collection. Here's a sample letter you can use to request debt validation. Sample Debt Validation Letter for Debt Collectors Use this letter to dispute a debt collection you're unsure of [your state here Attorney Generals office. Civil and criminal claims will be. Our Info Base is a collection of fact sheets, templates, downloadable forms, lodgement checklists, taxation details and other relevant information. Be sure to use a courteous tone when writing this letter, as you may want to maintain this customer's business, even if you must ask for cash payments from now on. If you receive a collection letter and plan to pay your overdue bill, it is a good idea to write a letter reassuring the creditor of that fact. Skeleton of a Demand for Payment Letter. We previously wrote about collecting on unpaid invoices, the advice is still the same, focus on the following essentials: . Using please, I request, thank you, and other words of kindness are a must. Legal Collection Letter is free for your use. The Legal Collection Letter should be used as final attempt to get customers to pay, before taking legal action. The Legal Collection Letter is a final effort to motivate clients or patients to pay now; and avoid costly the legal consequences a lawsuit may involve, such as; discovery, depositions, judgements, credit damage. The next time a collection agency or debt buyer company calls, get their company name and address. Then send them 1) a letter telling them they are not to call you anymore, and 2). Sample Collection Letters Updated on Jan 13, 2017 Personal visits, telephone calls, and letters are the three most common collection approaches that small business owners use to collect past due accounts. Thank you very much for your attention to this matter and your continued business. Sincerely, Contact Person at the Company Company Name Company Telephone Number Nothing on this site shall be considered legal advice and no attorneyclient relationship is established. One of the secrets of small business debt collection is to gradually increase the assertiveness of your follow up communication over time. Your first call, letter, or email should give your customer the benefit of the doubt with a positive and helpful tone. This is an example demand letter attempting to collect an unpaid debt. For more demand letters, see the Minnesota Demand Letters page. Watch This Before You Continue Collection agencies letters and Law office collection letters l have received the collection letters from Cavarly Collection Agency for a year. Now they transfer the dept to Law firm, which send me recently letter for collection again. Sample Authorization Letter to Collect Document. Below is an authorization to collect documents letter sample. As you can see, the letter is brief, and to the point, with no room for interpretation. This sample Collection Letter can help you address possible issues, resolve debts, and move forward. Use the Collection Letter document if: You want to collect payment for an outstanding debt. Collection letters are documents issued by collection agencies in order to extract unpaid debts from faulty debtors. They can also be issued by banks and credit card companies in order to send a warning to defaulters and to apprise them of the stern steps that the institution shall be forced to take in case of further nonpayment and delay. The worlds best collection letter is a very hardnosed, last resort technique I have personally used when all else fails. Its kind of like dropping a bomb on the pastdue payer. In case you missed my original blog post that explained all the details and content of the worlds best collection letter, its included again at the. Should the harsh collection letter not produce results, an attorney letter may be in order as well as the services of a collection agency. The following example is of a harsh collection letter which should be signed by the companys controller. Sample Letters for Demand For Payment, Strong Tone iSampleLetter Cookies help us maximise your experience on our website. By continuing, you agree to our use of cookies. Collection Letter Final Template Download Now. Simply fillin the blanks and print in minutes! Instant Access to 1, 800 business and legal forms. Download samples of professional document drafts in Word (. When you have a complaint or dispute with a creditor, lender, credit bureau, or debt collector, it's best to communicate in writing. Many disputes are time sensitive and a letter, especially when sent via certified mail with a return receipt request, gives you a timestamp to track the business. Free collection letter samples and sample debt collection letters to get your debtors attention and help you collect your money without using a collections agency. View our database of free collection letter samples (dunning notices) and sample debt collection letters that you can use; just cut, paste, and fill in your information and send. A Demand Letter is a formal notice that requests payment or action from an individual or a business. Demand Letters are generally used to resolve a dispute outside of court, with the aim of coming to a quick resolution and saving money on legal fees. Letter of authorization for collection. Authorization letters to proxies. Guide, letter example, grammar checker, 8000 letter samples This is the heavy duty collection letterthe industrial strength collection letterthis is what you want to use just before writing the account off, use an attorney, or go to a collection agency. Basically your loss becomes your customers gain. Sample Business Legal Letters A business legal letter is a legally binding letter written by a business to an individual or to another business. From accepting officespace lease terms to advising another business to cease and desist from violating intellectual property rights, the. On one hand, you want to maintain good customer relations and goodwill, but on the other you want to remain fiscally responsible and collect debt on past due accounts. Most important is your small business's reputation in the community. An Attorney Demand Letter will be sent to the address of the business and addressed to the name of the contact you have provided us. If no contact name is provided, we will address the letter to the accounts payable department. Sample Collection Letter Kavulich and Associates offers you a team of Westchester Business Debt Collections Lawyers specializing in Commercial and Business Debt Collections in NYC. Hire a Business Debt Collections Agency that can get fast results nationwide..